Transferring data from last year’s ProSeries client files

The transfer procedure is a simple way to start your clients’ ProSeries Basic Edition client files for this year using the relevant data stored in their ProSeries Basic Edition client files or ProSeries client files from last year.

|

If you used TurboTax or non‑Intuit tax software for the prior tax year, the data in last year’s data files can be moved into this year’s ProSeries client files.

|

When you complete the Options Setup Wizard or select OK in the Prior Year Settings Transferred dialog box the first time that you start the ProSeries Basic Edition program, you are asked if you want to transfer last year’s client files.

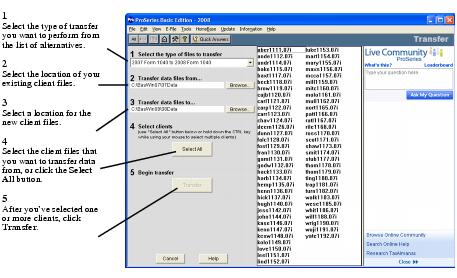

If you have last year’s ProSeries Basic Edition client files or ProSeries client files, click Yes to go to the Transfer window, then complete the five steps listed on the left side of the Transfer window.

|

▪

|

The choices for Step 1, “Select the type of files to transfer” are <last year> Form 1040 to <this year> Form 1040 and <this year> TurboTax 1040 to <this year> ProSeries 1040 because you can transfer data from last year’s ProSeries client files or this year’s TurboTax data files.

|

|

▪

|

The most likely entry for Step 2, “Transfer data files from” is C:\BasWinYY\YYData (the default location for last year’s ProSeries Basic Edition client files, where YY represents the last two digits of the tax year) or C:\ProWinYY\YYData (the default location for last year’s ProSeries client files, where YY represents the last two digits of the tax year).

|

When you click Transfer, the ProSeries Basic Edition program creates a new client file for each client whose data is being transferred, then transfers the applicable data into the new ProSeries Basic Edition client file for this year.

The Batch Transfer Status dialog box keeps you informed during the Transfer process, and the Transfer Log dialog box opens when the ProSeries Basic Edition program finishes transferring client data. Review the information, then click Close to go to HomeBase. HomeBase is discussed in Using HomeBase.

Electronic filing. If last year’s return was marked for electronic filing, that selection is transferred to this year’s return. PINs are not transferred, although an election to use PINs is. If a client’s federal return will be electronically filed using a PIN, open the client’s federal return, scroll down the Federal Information Worksheet to Part VI-Electronic Filing of Tax Return Information, then enter all applicable information.

|

If your firm will be filing returns electronically from more than one computer, and each computer is using the same EFIN, change the starting number in the DCN counter in the ProSeries Basic Edition program on all but one computer before opening any returns. For more information, see If more than one computer will be using the same EFIN.

|

|

For more information about transferring data from last year’s ProSeries Basic Edition client files or ProSeries client files, use the Search Help feature on the Help toolbar or in the Help Center to find the information that you want. (For instructions, see Getting information and help.)

|